Financial companies deal with tons of data every day, from transaction records to market feeds to customer information. Managing all this information across different systems can be messy and time consuming. A financial data warehouse is a centralized database that collects and organizes financial information from multiple sources, making it easier for businesses to analyze data and make better decisions. Think of it as a single location where all your financial data lives together in an organized way.

You might be wondering why financial institutions need a specialized warehouse for their data. When your financial information sits in different places like accounting software, bank systems, and spreadsheets, it becomes hard to get a complete picture of what’s happening. A financial data warehouse solves this problem by bringing everything together so you can run reports, spot trends, and understand your financial health without jumping between systems.

This setup helps your business move faster and smarter. You can track performance in real time, create accurate financial reports, and find insights that would be difficult to see when data is scattered. Whether you run a bank, investment firm, or any business that needs to manage complex financial information, understanding how these warehouses work can change the way you handle your data.

Key Takeaways

- A financial data warehouse centralizes all your financial information from different systems into one organized repository

- It enables faster reporting, better analytics, and helps you identify trends and make informed business decisions

- Proper implementation requires good integration strategies and following best practices to manage your data effectively

Core Concepts of Financial Data Warehousing

A financial data warehouse operates as a centralized system that collects and organizes financial information from multiple sources within your organization. It differs from regular databases by focusing on analysis rather than daily transactions, giving you the tools to understand patterns and make better financial decisions.

What Is a Financial Data Warehouse?

A financial data warehouse is a specialized storage system built specifically for managing financial information. You use it to bring together data from various sources like accounting software, ERP systems, and bank statements into one central location.

Unlike standard databases that handle daily transactions, your data warehouse is designed for analysis and reporting. It stores both current and historical financial data, making it easy for you to spot trends over time. This structure lets you run complex queries without slowing down your operational systems.

The warehouse organizes information in a way that makes sense for financial analysis. You can quickly access the data you need to create reports, track performance metrics, and support strategic planning across your organization.

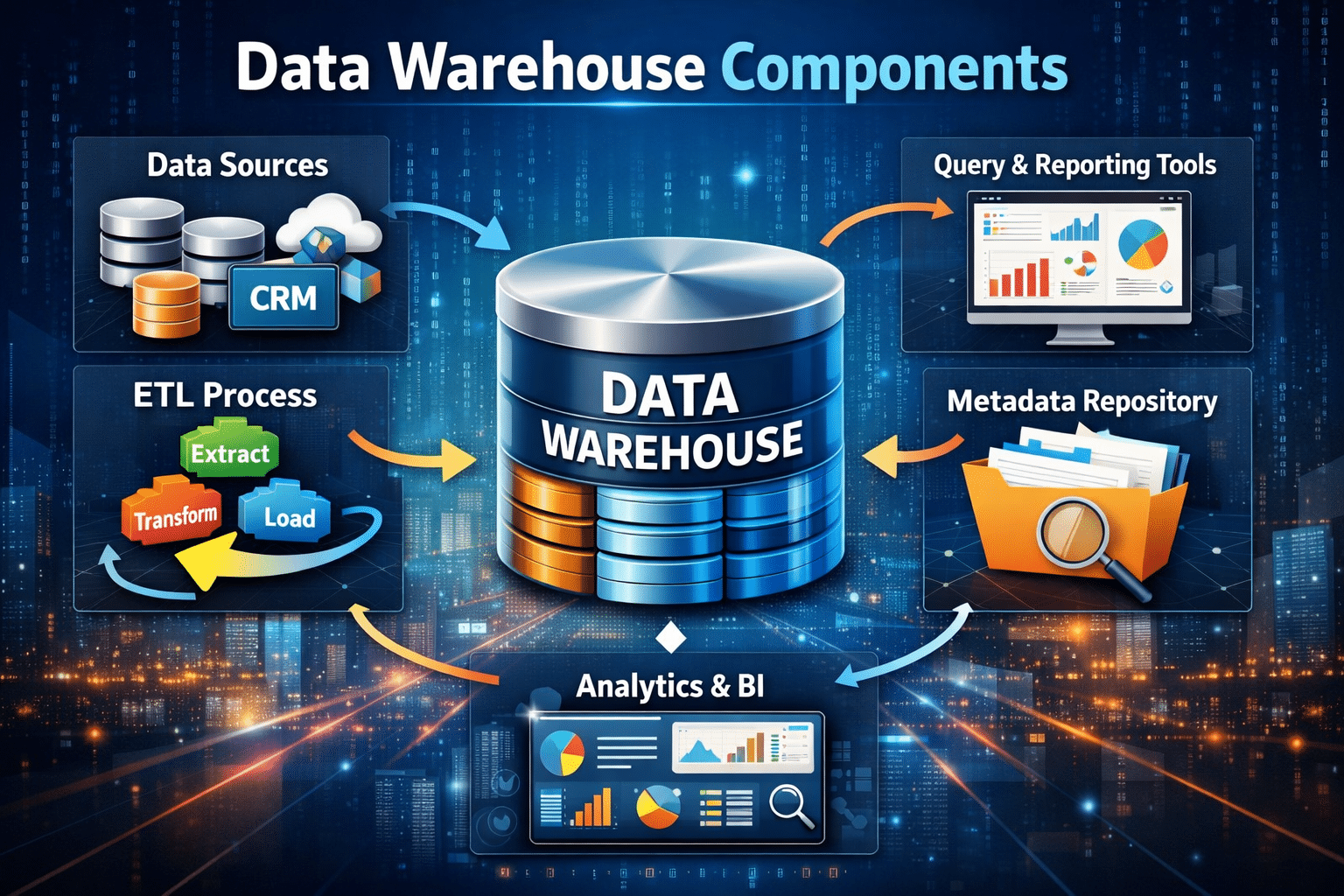

Key Components and Architecture

Your financial data warehouse consists of several essential layers that work together. The source layer pulls data from different systems across your organization. The staging area cleans and prepares this raw data before storage. The core storage layer holds your organized financial information in tables and structures optimized for queries.

The architecture also includes a presentation layer where you access reports and dashboards. This layer connects to business intelligence tools that help you visualize and analyze your financial data.

Most financial institutions use either a centralized warehouse or a distributed approach. A centralized system keeps everything in one place, while a distributed model spreads data across multiple locations. Your choice depends on your organization’s size and specific needs.

Types of Data Stored in Financial Data Warehouses

Your data warehouse stores several categories of financial information. Transaction data includes all your sales, purchases, payments, and receipts. Account data covers balances, ledger entries, and account structures.

You also store customer financial data like credit histories, payment patterns, and account relationships. Regulatory and compliance data helps you meet reporting requirements and audit standards.

Performance metrics and KPIs live in your warehouse too. These include revenue figures, expense ratios, profit margins, and cash flow measurements. Historical versions of all this data remain available, letting you compare performance across different time periods and identify long term trends in your finance operations.

Benefits and Use Cases of Financial Data Warehouses

Financial data warehouses deliver practical value through better analytics, faster reporting, easier compliance tracking, and smarter risk management. These systems turn scattered financial information into organized data that helps you make confident business decisions.

Enhanced Analytics and Business Intelligence

A financial data warehouse gives you the power to run advanced analytics across all your financial information in one place. You can analyze patterns, spot trends, and generate actionable insights that would be impossible to find when data sits in separate systems.

Business intelligence tools connect directly to your data warehouse to create dashboards and reports. This means you can see your complete financial picture without switching between different platforms or waiting for IT to pull data together.

Data mining becomes much easier when everything is centralized. You can search through years of transactions, customer behavior, and market data to find connections that help improve profitability. The warehouse stores historical information alongside current data, so you can compare performance across different time periods.

Your teams can run complex queries without slowing down operational systems. This separation means analysts can explore data freely while your transaction systems keep running smoothly.

Streamlined Financial Reporting

Financial reporting gets faster and more accurate with a data warehouse. You pull from a single source of truth instead of combining data from multiple systems where numbers might not match.

Monthly, quarterly, and annual reports generate in minutes instead of days. Your finance team spends less time gathering data and more time analyzing what the numbers mean. Automated reporting pulls fresh data on schedule, so stakeholders get updates without manual work.

The consistency matters when different departments need the same information. Marketing, sales, and finance all see identical numbers because they draw from the same warehouse. This eliminates confusion and debates about which version of the data is correct.

You can also create custom reports for different audiences without building new data pipelines. Executives might need high level summaries while department managers want detailed breakdowns, and the warehouse supports both needs from the same data foundation.

Regulatory Compliance and Audit Trail

Regulatory compliance becomes manageable when your data warehouse maintains complete records of all financial transactions. Banks and financial institutions must follow strict rules about data retention, and a warehouse makes this automatic.

Every change gets tracked with timestamps and user information. This audit trail shows exactly who accessed or modified data and when it happened. Auditors can review your complete financial history without disrupting daily operations.

AML (anti money laundering) systems rely on data warehouses to scan transactions for suspicious patterns. The warehouse stores enough historical data to establish normal behavior baselines, making unusual activity easier to detect.

When regulators request information, you can produce reports quickly because everything is already organized and validated. The warehouse structure makes it simple to prove compliance with data quality standards and retention requirements.

Advanced Risk Management

Risk management improves dramatically when you can analyze your complete exposure across all business areas. A data warehouse combines information about loans, investments, customer accounts, and market data to give you total visibility.

Credit risk assessment becomes more accurate with access to comprehensive customer histories and external data sources. You can evaluate loan applications against years of performance data and current market conditions simultaneously.

Portfolio management benefits from real time analytics that show how different assets interact under various scenarios. You can model potential outcomes based on historical patterns and current trends to make smarter investment decisions.

Financial analysis tools can stress test your positions against market changes or economic shifts. The warehouse provides the deep historical data needed for forecasting models that predict future performance based on past patterns.

Your risk teams can set up automated alerts that monitor key indicators and flag potential problems before they become serious. This proactive approach catches issues early when you still have time to adjust your strategy.

Data Management and Integration Strategies

Successful financial data warehouses depend on effective integration methods that combine data from multiple sources, rigorous quality controls that maintain accuracy, and smart modeling approaches that transform raw information into usable business assets.

Data Integration and ETL Processes

ETL processes form the backbone of your financial data warehouse operations. Extract, Transform, Load operations pull data from various financial systems like accounting software, payment processors, and banking platforms into a centralized location.

The extraction phase connects to source systems and retrieves relevant financial records. Your systems might pull data from spreadsheets, databases, APIs, or legacy applications. This step requires careful planning to avoid disrupting operational systems during business hours.

Transformation happens in the middle layer where raw data gets cleaned, formatted, and standardized. You convert currencies, standardize date formats, and align account codes across different systems. This stage also handles calculations like exchange rate conversions and aggregate summaries.

Loading brings the processed data into your warehouse. You can choose full loads that replace entire datasets or incremental loads that add only new and changed records. Incremental loading saves time and computing resources for large financial datasets.

Ensuring Data Quality and Accuracy

Data quality directly impacts the reliability of your financial reporting and analysis. Poor quality data leads to incorrect insights and flawed business decisions.

Key quality dimensions include:

- Completeness: All required fields contain values

- Consistency: Data matches across different sources

- Validity: Values fall within acceptable ranges

- Timeliness: Information reflects current business states

Data cleansing removes duplicates, fixes formatting errors, and fills in missing values where possible. You establish validation rules that check incoming data against predefined standards before it enters the warehouse. For example, transaction amounts must have valid account codes and posting dates cannot be in the future.

Data lineage tracking shows where information comes from and how it changes through each processing step. This creates an audit trail that helps you troubleshoot issues and maintain regulatory compliance. When numbers look wrong, you can trace them back to their original source.

Data Modeling and Transformation

Data modeling defines how you structure and organize financial information in your warehouse. The right model makes queries faster and reports easier to build.

Star schemas work well for financial data warehouses. You place transaction facts in a central table connected to dimension tables for accounts, dates, departments, and cost centers. This structure supports quick aggregations and flexible filtering.

Data transformation converts structured data from operational formats into analytical formats. You might denormalize tables to reduce joins, create calculated fields like profit margins, or build time series for trend analysis. Historical data gets preserved in slowly changing dimensions that track how values evolve over time.

Transformation logic also handles business rules specific to your organization. This includes custom account hierarchies, allocation formulas, and consolidation procedures. These rules stay consistent across all reports and analyses when embedded in your data model.

Implementation Considerations and Best Practices

Building a financial data warehouse requires careful planning around technical infrastructure, security protocols, and user access. These factors determine whether your warehouse will meet current needs and adapt to future demands.

Scalability and Performance

Your data warehouse must handle growing transaction volumes and user queries without slowing down. Financial institutions typically process millions of transactions daily, and this volume only increases over time.

Start by estimating your data growth rate for the next three to five years. Most financial data warehouses grow between 30% to 50% annually. Choose hardware and software that can expand storage and processing power without requiring a complete system rebuild.

Key performance factors include:

- Query response times for financial reports

- Concurrent user capacity during peak hours

- Data loading speeds for batch processes

- Real time analytics capabilities

Partition your data tables by date or account type to speed up queries. This means breaking large tables into smaller segments that your system can search more quickly. Index frequently accessed columns like account numbers, transaction dates, and customer IDs.

Cloud-Based Data Warehousing Solutions

Cloud platforms offer financial institutions flexible and cost effective alternatives to traditional on premise systems. You pay only for the storage and computing power you actually use rather than maintaining expensive hardware.

Major cloud providers offer specialized services designed for financial data. These platforms automatically scale resources during high demand periods like month end reporting or tax season. Your team can access data from any location with proper security credentials.

Migration to cloud based data warehouse systems reduces IT maintenance costs by 40% to 60% compared to traditional setups. The cloud provider handles software updates, security patches, and infrastructure monitoring. This frees your technical team to focus on data analysis rather than system maintenance.

Consider hybrid approaches that keep sensitive data on premise while moving less critical information to the cloud. This gives you flexibility while maintaining control over regulated financial information.

Data Security and Governance

Financial data warehouses store sensitive customer information and transaction records that require strict protection. You must implement multiple security layers to prevent unauthorized access and meet regulatory requirements.

Encrypt all data both when stored and during transmission between systems. Use role based access controls that limit what each user can view or modify based on their job responsibilities. A loan officer should not access investment portfolio details, for example.

Essential governance practices:

- Regular security audits and penetration testing

- Detailed logging of all data access and changes

- Clear data retention policies aligned with regulations

- Documented procedures for data quality checks

- Established protocols for handling data breaches

Create a data governance committee that includes representatives from IT, compliance, and business units. This team defines data standards, approves new data sources, and ensures your warehouse meets industry regulations like SOX or Basel III.

Improving Data Accessibility

Your financial data warehouse only creates value when users can easily find and analyze the information they need. Complex systems that require extensive technical knowledge limit adoption and reduce return on investment.

Implement self service analytics tools that let business users create reports without writing code. Modern platforms offer drag and drop interfaces where analysts can explore data and build visualizations quickly. This reduces the backlog of requests to your IT department.

Standardize data definitions across your organization. When different departments use terms like “revenue” or “customer” differently, reports become confusing and unreliable. Build a data dictionary that explains each field and calculation in plain language.

Monitor which reports and datasets your teams use most frequently. Create optimized views or data marts for these common queries to improve speed and user experience. Train employees on available data and tools through regular workshops and documentation.